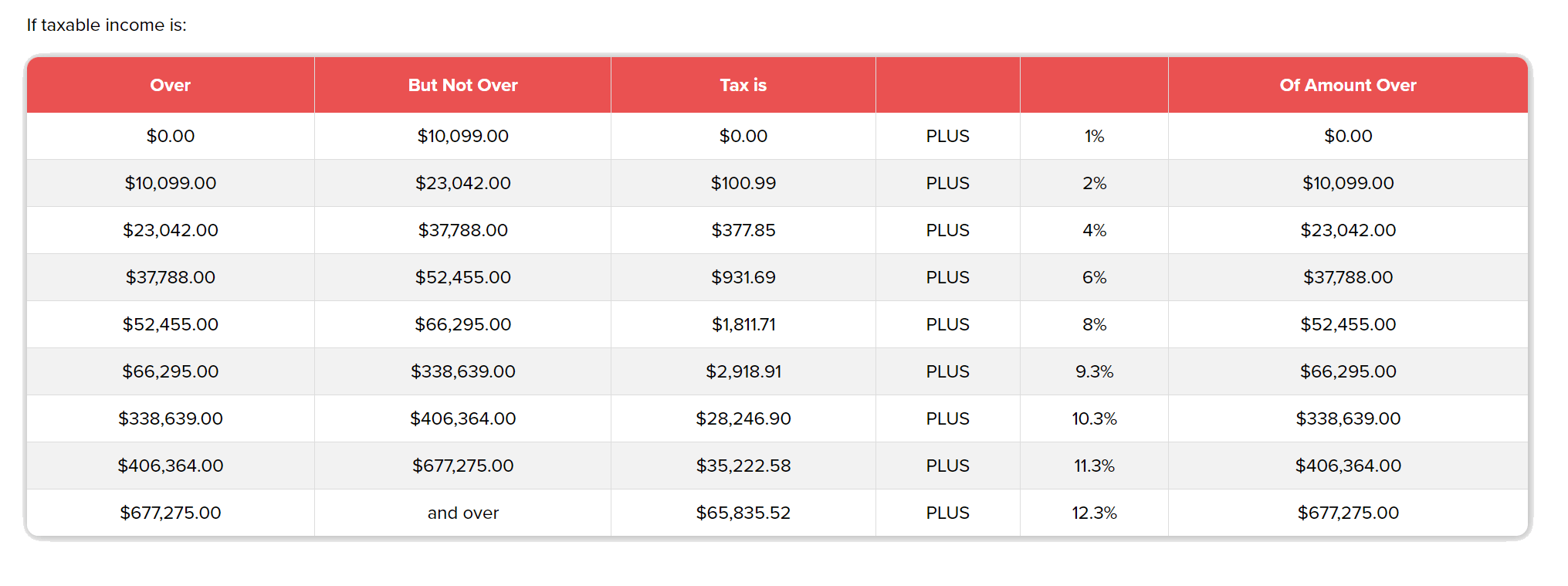

California Tax Brackets 2024 Married Filing Jointly. Married filing jointly is the filing type used by taxpayers who are legally married (including common law marriage) and file a combined joint income tax return rather than two individual. Note, the list of things not included, such as.

California married (joint) filer standard deduction. California tax brackets for married filing jointly and qualifying surviving spouse/rdp.

California Tax Brackets 2024 Married Filing Jointly Images References :

Source: katahyacinthie.pages.dev

Source: katahyacinthie.pages.dev

2024 Ca Tax Brackets Married Filing Jointly Zenia Zondra, In this blog post, we will explain everything you need to know about california tax brackets 2024, including the rates, the deductions, and the credits that can lower your tax bill.

Source: jemimaqmatelda.pages.dev

Source: jemimaqmatelda.pages.dev

Tax Bracket Married Filing Jointly 2024 Annis Hedvige, California grants an automatic six.

Source: adrianewaleta.pages.dev

Source: adrianewaleta.pages.dev

California Tax Brackets 2024 Married Jointly Brinn Clemmie, California tax brackets for married filing jointly and qualifying surviving spouse/rdp.

Source: adrianewaleta.pages.dev

Source: adrianewaleta.pages.dev

California Tax Brackets 2024 Married Jointly Brinn Clemmie, This page has the latest california brackets and tax rates, plus a california income tax calculator.

Source: trixyqphaidra.pages.dev

Source: trixyqphaidra.pages.dev

California Tax Brackets 2024 Married Filing Jointly Aggie Sonnie, California married (joint) filer standard deduction.

Source: ameliebmellisa.pages.dev

Source: ameliebmellisa.pages.dev

California Tax Brackets 2024 2024 Married Filing Jean Corrianne, California married (joint) filer tax tables

Source: www.trustetc.com

Source: www.trustetc.com

2024 Tax Brackets Announced What’s Different?, The deadline to file a california state tax return is april 15, 2024, which is also the deadline for federal tax returns.

Source: annalisewagace.pages.dev

Source: annalisewagace.pages.dev

Tax Brackets 2024 Married Jointly California Dody Carleen, Explore the latest 2024 state income tax rates and brackets.

Source: karelydierdre.pages.dev

Source: karelydierdre.pages.dev

Us Tax Brackets 2024 Married Jointly Vs Separately Barb Marice, See states with no income tax and compare income tax by state.

Source: adoreemirabelle.pages.dev

Source: adoreemirabelle.pages.dev

2024 Tax Brackets Single California Jessie Diandra, California's 2024 income tax ranges from 1% to 13.3%.

Category: 2024